Table Of Content

- Cadence Design Systems Earnings: Revenue Deceleration and Weak Quarterly Guidance Spark Concern

- Cadence Design Systems Inc CDNS

- Declining Stock and Solid Fundamentals: Is The Market Wrong About Cadence Design Systems, Inc. (NASDAQ:CDNS)?

- Software - Application Industry Comparables

- Cadence Design Systems (CDNS) Stock Price, News & Analysis

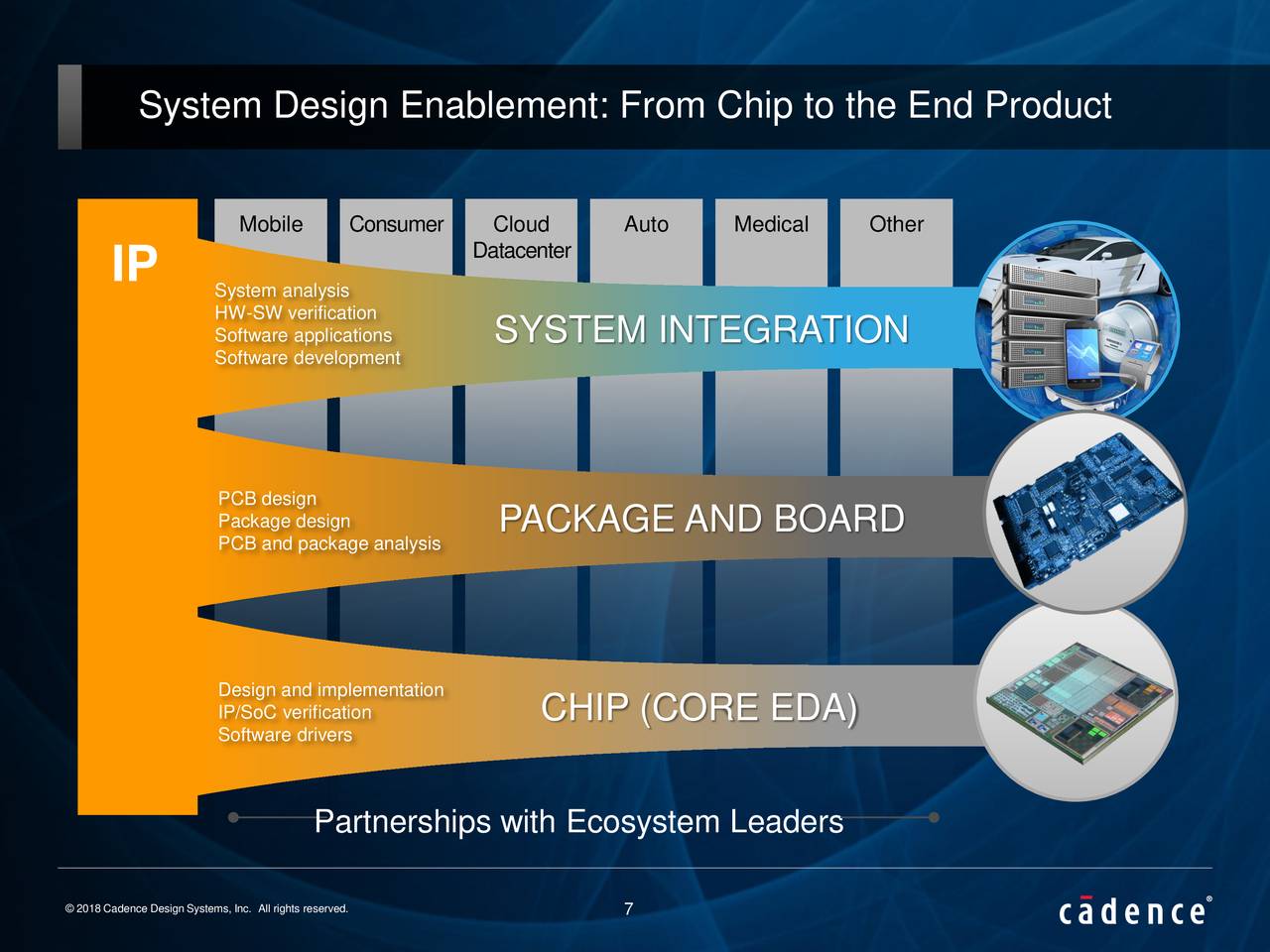

As these technologies drive the development of specialized chips and accelerators, Cadence's design tools and IP solutions play a crucial role in supporting the innovation and optimization of these products. Additionally, the growing adoption of 5G and the Internet of Things (IoT) presents opportunities for Cadence to provide solutions that enable seamless connectivity and efficient data processing. The broader electronic design automation (EDA) industry is a critical enabler of semiconductor development, enabling the creation of sophisticated chips and electronic systems. Cadence Design Systems has established itself as a prominent player in this competitive landscape, offering a diverse portfolio of EDA solutions and IP offerings. The company's competitive advantages include its rich history of technological expertise, an extensive customer base, and a comprehensive product suite. Moreover, Cadence's strategic partnerships with leading semiconductor manufacturers and system integrators further enhance its competitive positioning.

Griffin Securities Analysts Lower Earnings Estimates for Cadence Design Systems, Inc. (NASDAQ:CDNS) - MarketBeat

Griffin Securities Analysts Lower Earnings Estimates for Cadence Design Systems, Inc. (NASDAQ:CDNS).

Posted: Fri, 26 Apr 2024 17:41:15 GMT [source]

Cadence Design Systems Earnings: Revenue Deceleration and Weak Quarterly Guidance Spark Concern

As the semiconductor landscape evolves rapidly, Cadence must address technological advancements and changing customer preferences to remain relevant. In managing these risks, Cadence employs various risk management strategies, including diversification of its product portfolio, ongoing investments in research and development, and maintaining strong customer relationships. Cadence Design Systems, Inc. is a leading American multinational computational software company headquartered in San Jose, California. Founded in 1988 through the merger of SDA Systems and ECAD, Inc., Cadence has become a major player in the electronic design automation (EDA) industry.

Cadence Design Systems Inc CDNS

For the current fiscal year, the consensus earnings estimate of $5.93 points to a change of +15.2% from the prior year. Chip design software giant Cadence Design Systems (CDNS) topped first-quarter estimates but its guidance missed Wall Street’s current-quarter earnings and sales forecasts, sending its shares tumbling in extended trading Monday evening. The company's product offerings include software tools for custom IC design, digital implementation, and verification technologies. Cadence's custom IC design tools enable engineers to create unique and optimized integrated circuits tailored to specific applications. The digital implementation tools streamline converting a chip's logic design into a physical layout, optimizing its performance and power consumption. Furthermore, Cadence provides a wide range of verification technologies, such as simulation and formal verification, to ensure the correctness and reliability of chip designs.

Declining Stock and Solid Fundamentals: Is The Market Wrong About Cadence Design Systems, Inc. (NASDAQ:CDNS)?

The company specializes in providing software, hardware, and silicon structures that facilitate the design of integrated circuits, systems on chips (SoCs), and printed circuit boards. The history of Cadence Design Systems traces back to 1988, when the company was formed through the merger of SDA Systems and ECAD, Inc. SDA Systems was founded in 1983 by Dr. Alberto Sangiovanni-Vincentelli and Dr. Richard Newton, and it was known for its innovations in circuit design technology. ECAD, Inc. was a pioneer in electronic design software and had a strong presence in the EDA market.

Software - Application Industry Comparables

The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1's and #2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4's and #5's.

Cadence Design Systems (CDNS) Stock Price, News & Analysis

9 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Cadence Design Systems in the last twelve months. The consensus among Wall Street analysts is that investors should "moderate buy" CDNS shares. Over the past few years, Cadence Design Systems has demonstrated solid financial performance, with impressive revenue growth and increasing net income. This revenue growth reflects Cadence's ability to meet the evolving demands of its target market and deliver innovative solutions. The increase in net income showcases Cadence's efficient cost management and successful execution of its business strategies. Furthermore, Cadence Design Systems achieved a healthy net profit margin indicating the company's ability to generate profits while maintaining a competitive pricing strategy.

The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. New Rank-Based ScoringMarketRank™ is calculated by averaging available category scores (with extra weight given to analysis and valuation), then ranking the company's weighted average against that of other companies. Secular tailwinds in chip design such as 5G, Inernet of Things, AI/ML, and others should increase demand for EDA tools and support growth for Cadence. As an investor, you want to buy stocks with the highest probability of success.

Key Executives

Cadence Design Systems, Inc. provides software technology, design and consulting services and technology. The Company licenses its electronic design automation software technology and provides a variety of professional services. Cadence's design realization solutions are used to design and develop complex chips and electronic systems, including semiconductors.

Analyst Recommendations on Cadence Design Systems, Inc.

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

While the EDA industry presents significant growth opportunities, Cadence must remain agile and adapt to evolving market dynamics. Continued investment in research and development, strategic acquisitions, and a customer-centric approach will be vital in maintaining a competitive edge in the industry. The company’s revenue guidance for the period of $1.03 billion to $1.05 billion also missed the mark, which Wall Street had modeled at $1.11 billion.

The company's IP solutions encompass various pre-designed semiconductor components, enabling faster and more efficient chip development. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum.

Cadence's valuation metrics indicate that the company is trading at a premium compared to its peers. This premium valuation may reflect investors' confidence in Cadence's growth potential and its position as a key player in the EDA industry. The factors driving Cadence's valuation include its consistent revenue and earnings growth, strong market position, and the potential for continued innovation and expansion. The company's focus on artificial intelligence and machine learning in chip design provides a strategic advantage in meeting the industry's evolving needs. Various factors, such as market dynamics, industry trends, and macroeconomic conditions, could influence recent changes in investor sentiment.

Following the merger, Cadence quickly established itself as a leader in the EDA space, providing cutting-edge solutions for complex design challenges. Over the years, the company has continued to innovate and expand its product portfolio, catering to the evolving needs of the semiconductor industry. Due to the size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, Cadence is rated Zacks Rank #3 (Hold). Cadence Design Systems is well-positioned to capitalize on several growth opportunities in the semiconductor landscape. With the increasing demand for more complex and power-efficient chips, the company's expertise in advanced node design and low-power solutions becomes critical. The rising prominence of artificial intelligence, machine learning, and data center technologies offers significant growth potential for Cadence.

675 employees have rated Cadence Design Systems Chief Executive Officer Lip-Bu Tan on Glassdoor.com. This puts Lip-Bu Tan in the top 20% of approval ratings compared to other CEOs of publicly-traded companies. Cadence is graded F on this front, indicating that it is trading at a premium to its peers.

Click here to see the values of some of the valuation metrics that have driven this grade. Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next days. The company is scheduled to release its next quarterly earnings announcement on Monday, July 22nd 2024. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Interoperability of EDA tools poses a risk that influential customers could switch to a different vendor with relative ease, which could have an impact on long-term growth. Privacy Policy ¿¿|¿¿ No cost, no obligation to buy anything ever.Past performance is no guarantee of future results. The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Cadence. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term.

No comments:

Post a Comment